Since 2007, Innovations Global Services Pvt. Ltd. is offering

CERTIFICATE COURSE IN

STOCK MARKET

100% Practical Training

Classes: 2 months (60 Hours) – Online/Offline Course

The purpose of this course is to equip the student with the required stock market knowledge on academic front and functional know-how so that learners can implement the same in studying equity markets for revenue generation like they can invest themselves in the stock market.

It precedes you to the process of how to discover and examine companies, ascertain the risk of a stock, proper entry, know why markets move and encourage you to choose the right trading style using the accurate approach.

Upgraded Skillset:

Our professionals will introduce you to the changing methods and approaches for the Stock Market which are aligned with global training methodology.

Structured Mode:

Our course consist of 8 topics which can be completed in 60 days through regular learning. We have designed multiple batches according to the time flexibility for both online and classroom lectures which you can opt as per your time availability for weekdays and weekends.

1. Primary / Equity Market:

The primary market provides you with an insight into the equity segment and provides real-time quotes, other statistics on equities market and in-depth information regarding listing of securities, trading systems & processes, clearing and settlement, risk management, traded volumes, number of trades, companies listed, market capitalization, etc.

2. Secondary / Derivatives Market:

Derivatives are financial securities and are financial contracts that obtain value from something else, known as underlying securities. Underlying securities may be stocks, currency, commodities or bonds, etc. Derivatives are usually leveraged instruments, which increases their potential risks and rewards.

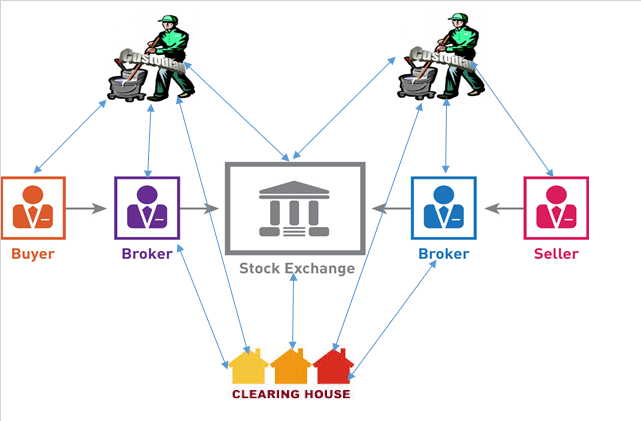

3. Trading, Clearance & Settlements:

Stock exchanges ensure a platform for trading, while clearing corporation ensures the funds and securities related issues of the trading members and make sure that the trade is settled through the exchange of obligations. The depositories and clearing banks provide necessary interface between the custodians or clearing members for settlement of securities and funds obligations.

4. Depositories:

Depositories are institutions which hold your securities (Shares, bonds, debentures,

Mutual Fund Units) in electronic form which is also known as dematerialization of

shares or DEMAT account. So, Depositories are mainly responsible and accountable for safe-keeping of your securities and keep a record of all your trades.

5. Code of Conduct & Investor Protection:

Investors are the pillar of the financial and securities market. They put the money

in funds, stocks, etc. to help grow the market and thus, the economy. It is thus very

important to protect the interests of the investors. Investor protection involves various measures established to protect the interests of investors from malpractices.

6. Commodity Market:

Commodity Market is about trading of precious metals, energy, oil, spices & so on. Individuals aiming to diversify their portfolio can undertake investments in both perishable and non-perishable products, thereby not only mitigating the risk factor,

but also providing a hedge against inflation rates in an economy.

7. Mutual Funds, IPO, Insurance:

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. An initial public

offering (IPO) refers to the process of offering shares of a private corporation to

the public in a new stock issuance.

8. Portfolio Management Services:

The term portfolio means the basket of asset classes such as equity, debt, commodities, cash, etc. Portfolio management is the art and science of selecting

managing appropriate combination of securities to generate optimum return and reducing risk through proper diversification.

- Certificate of Completion.

- Resume making tips

- Placement assistance