Since 2007, Innovations Global Services Pvt. Ltd. is offering

CERTIFICATE COURSE IN

TALLY ERP 9.0/GST

100% Practical Training

Classes: 2 months (60 Hours) – Online/Offline Course

Tally ERP 9 & GST covers in-depth understanding to adhere to the accounting fundamentals of the business. We not only teach the concepts but also helps you learn how you can practically implement those concepts in your Day to Day Accounting Process with practical examples and entries in tally.

Upgraded Skillset:

Skillset: Our professionals will introduce you to the changing methods and approaches for the Tally ERP 9.0/GST which are aligned with global training methodology.

Structured Mode:

Our course consist of 8 topics which can be completed in 60 days through regular learning. We have designed multiple batches according to the time flexibility for both online and classroom lectures which you can opt as per your time availability for weekdays and weekends.

1. Basic Accounting:

Accounting is the practice of recording and reporting on business transactions. The

resulting information is an essential feedback loop for management, so that they can see how well a business is performing against expectations.

2. Golden Rule of Accounting:

Golden rules convert complex bookkeeping rules into a set of principles which can

be easily studied and applied. The golden rules of accounting allow anyone to be a

bookkeeper. They only need to understand the types of accounts and then diligently apply the rules.

3. Ledger Posting & Bank Reconciliation:

The general ledger stores business transactions organized by account. Reconciling the general ledger ensures you correctly recorded each transaction by comparing

source documents — statements, checks, and invoices — with accounting records.

4. Voucher & Inventory Entries:

A Voucher is a document that contains details of a financial transaction. For every transaction, you can use appropriate Tally Voucher to enter the details into the ledgers and update the financial position of the company.

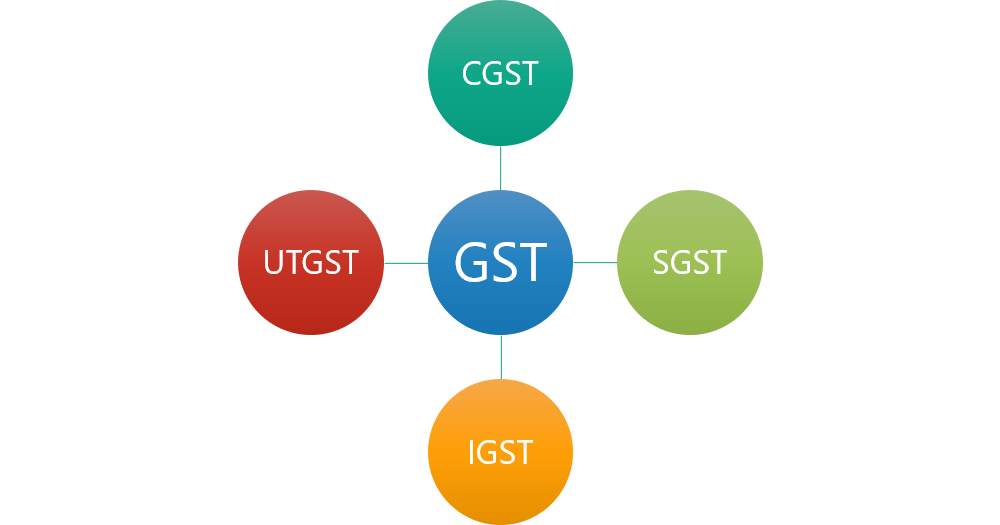

5. Overview of GST:

It is destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as set off. In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer.

6. Rules of CGST, SGST, UGST, IGST:

The GST to be levied by the Centre on intra state supply of goods and / or services

is Central GST (CGST) and that by the States is State GST (SGST). On supply of goods and services outside the state, Integrated GST (IGST) will be collected by Centre. IGST also applies on imports as well.

7. Filing GST Returns and Credits:

The GST Council and the Ministry of Finance have come up with a great solution

to record all such invoices in one place and collate data for the taxpayer. The

processes have been simplified, and many taxes have been removed. The whole

nation shall report using the same structure irrespective of where and how you

carry your business.

8. GST in Tally ERP 9.0:

Tally.ERP 9 ensures that your GST returns are in sync with your books of accounts, and reflect the same data as used for filing returns in the GST portal, thus proving to be the right GST return software for you.

What you will Gain After Training

- Certificate of Completion.

- Resume making tips

- Placement assistance